Planning a trip? Willing to gamble and forego the cost of travel insurance? Let me share some true horror stories, disguised to protect the victims who now, I’m willing to bet, never travel without it.

Convincing Tales

Scary Story # 1: A USA couple are on a cruise ship off the coast of the Falkland Islands when she develops symptoms of an intestinal obstruction. The ship docks; a ferry transports her to an island hospital where doctors insist she should go home ASAP. If you have never traveled to the Falklands you may not know that airline flights to the closest countries fly only on Saturdays. Saturday is 5 days away. A helicopter can transport her to Chili where she can fly back to the United States but the couple must front $30,000.00 (yes, thirty thousand dollars) for the helicopter transport. Fortunately, they have international travel insurance that covers medical emergencies such as these and the husband can focus on his wife’s care and not worry about their financial affairs.

Scary Story # 2: A USA couple is traveling in an Asian country when he suffers a heart attack. Unfortunately, after spending several days in a hospital, he passes away. They do not have traveler’s insurance. The country charges thousands for his medical care (only some of the cost is covered by his health insurance) and thousands for repatriation of his body.

Scary Story # 3: A family rents a luxury home for a month and declines the vacation insurance. They stay in the home one week when an immediate family member dies (not unexpectedly). The family returns home. The agency makes every effort to rent the property to other guests for the three remaining weeks on the reservation but are unsuccessful. The family is upset with the management company for not reimbursing three weeks of their rental fee which is thousands of dollars.

Do Your Homework

Don’t leave home without traveler’s insurance! It doesn’t cover everything but most of us can’t afford to travel without it. Good travel insurance can cover medical expenses, emergency evacuations, trip delays, lost luggage, reimbursement for nonrefundable reservations, missed or cancelled flight connections and accidental death.

According to travel experts, finding good travel insurance policies that have extensive coverage and pay claims promptly is not difficult. It can be as easy as checking the YES box when you book flight or vacation home reservations. Extensive coverage isn’t perfect though so read the fine print to avoid worthless policies and know what is excluded. At the least, there are limits on pre-existing conditions and refundable fees so read carefully. Be wary of “trip protection” which is usually cheaper but often has more extensive restrictions on eligibility for reimbursements. Instead, choose comprehensive insurance plans.

The U.S. Travel Insurance Association says travel insurance prices vary but are usually 4 – 10% of the cost of the trip options you are insuring. Some credit card companies offer rental car or trip cancellation insurance when reserving with their credit card. Again, read the fine print and understand your coverage limits.

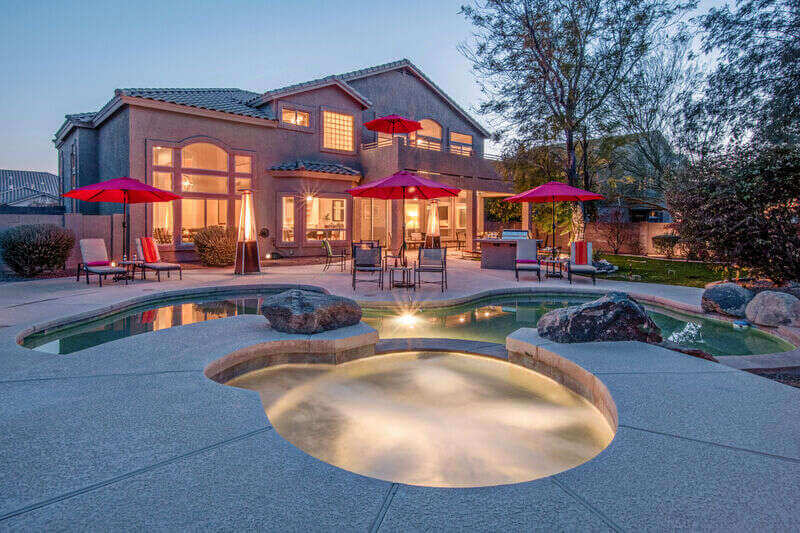

Arizona Vacation Home Rentals includes the option to insure your trip when you book your reservation. You are eligible to elect travel insurance up to one week before your arrival date. Did I say you need to read the fine print? Please do!

A gambler’s share in travel can be high stakes. Do your homework, be informed and get insurance!

Save money and support local business by booking directly through

Arizona Vacation Home Rentals

Phone/Text: 480.626.4072